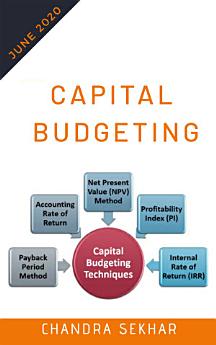

CAPITAL BUDGETING: decision methods - PBP, DPBP, ARR, NPV, PI, IRR, MIRR (theory and interpretation)

About this ebook

· To demonstrate to readers that the subject of CAPITAL BUDGETING decision methods simple to understand, relevant in practice and interesting to learn.

· To help managers appreciate the logic for making better investment decisions.

· To explain the concepts and theories of Capital budgeting decision methods in a simple way so readers could grasp them very easily and be able to put them in to practice.

· To create a book that differentiates itself from other books in terms of coverage, theory and data presentation.

This book useful to Students, Job Interviews, Investors, Financial advisers, Financial managers and Fund managers to relate theories, concepts and data interpretation to practice.

This book deals with topic in Investment analysis is Capital Expenditure Decisions. This book covers the Introduction of Capital Budgeting, Capital Budgeting techniques(methods), Estimating project Cash flows and Project Analysis. Illustrating the Payback period(PBP), Discounted Payback Period(DPBP), Average rate of return(ARR), Net Present Value(NPV), Profitability Index(PI), Internal Rate of Return(IRR) and Modified Internal Rate of Return(MIRR). By study this book, the efficient financial decision makers can able to put their more efforts to take decisions with regarding to the allocation of funds among alternative investments in suitable projects.

The common terms are used in this book are Cost of capital, Discount factor, Rate of return, Present value of cash inflows, Present value of cash outflows, Future value of cash inflows, Earnings before depreciation and tax(EBDT), Earnings before tax(EBT), Earnings after tax(EAT), Net Cash flows(NCF)etc…

This book CAPITAL BUDGETING decision methods aims to assist the reader to develop a thorough understanding of the concepts and theories underlying financial management in a systematic way. To accomplish this purpose, the recent thinking in the field of finance has been presented in a simplest, and precise manner.

The main features of the book are simple understanding and key concepts.

The book contains a comprehensive analysis of topics on ratio analysis with a view that readers understand financial decisions thoroughly well and are able to evaluate their implications for investors of the company.

The text material has been structured to focus on Capital budgeting methods is in the investment decision making process.

The book discusses the theories, concepts, assumptions, underlying investment decisions.

It is hoped that this will facilitate a better understanding of the subject matter.

Ratings and reviews

About the author

Chandra Sekhar holds an M.Com., and MBA in Finance during 2007-09 from Sri venkateswara university college of Commerce, Management and Information Sciences, Sri venkateswara university. He has also got certifications in Finance field from National Stock Exchange and Bombay Stock Exchange. He has been working with Conduent, Bangalore in Finance and Accounts field. He worked in Capgeminini, and Shahi exports private limited. He also served in external audit field for large companies like MRF, Aventis pharma limited, and Zydus Cadila health care limited, etc. Chandra Sekhar’s general area of expertise lies in writing books and articles in Financial accounting, Cost and Management accounting. His specific research interest is in Cost Accounting, Financial decision-making process mainly through Ratio analysis, Capital budgeting decisions, Capital markets and financial services. He is the author of more than 35 books and management cases.